Securing the right funding is one of the biggest challenges every startup faces. Whether you’re just getting started or ready to scale, understanding your funding options and how to approach them can make all the difference.

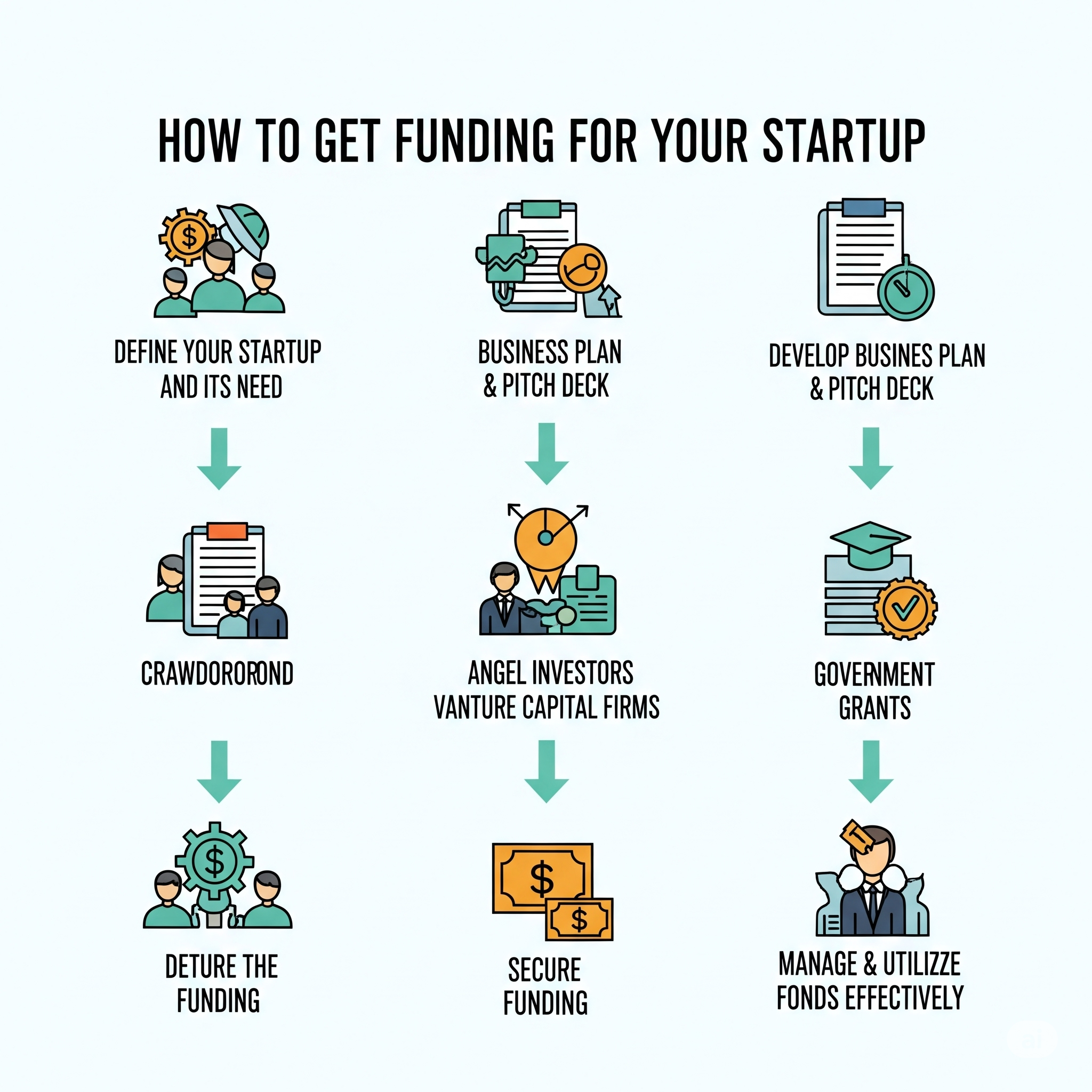

Below is a step-by-step guide to help you navigate the process of getting startup capital in the U.S.

1. Understand Your Funding Needs First

Before seeking funding, clearly define how much capital you need and what it will be used for.

- Estimate your startup costs (equipment, marketing, development, salaries, etc.)

- Identify your funding stages – Pre-seed, Seed, Series A, etc.

- Know if you’re raising for growth, operations, or product development

- Be ready to explain your burn rate and runway

2. Explore Different Types of Startup Funding

There are many funding sources available, each with its own pros and cons. Here’s an overview:

- Bootstrapping – Using your own savings; gives full control but limited capital

- Friends and Family – Easier access but can be risky for personal relationships

- Angel Investors – Wealthy individuals who invest in early-stage startups

- Venture Capitalists (VCs) – Firms that invest in scalable, high-growth startups

- Bank Loans or SBA Loans – Ideal for startups with some traction or assets

- Crowdfunding – Platforms like Kickstarter or Indiegogo for product-based funding

- Grants and Competitions – Non-dilutive funding from government or organizations

3. Build a Solid Business Plan and Pitch Deck

Investors and lenders want to see a clear, compelling plan. You need both a business plan and a pitch deck that highlight your potential.

- Business Plan – Include company overview, market research, financials, and growth strategy

- Pitch Deck – 10-15 slide presentation with your problem, solution, market size, business model, traction, and financial projections

- Tailor both for the specific type of investor you’re approaching

4. Perfect Your Elevator Pitch

Be prepared to clearly explain your startup in under 60 seconds. Your elevator pitch should quickly communicate:

- What your startup does

- What problem it solves

- How big the market is

- Why you’re the right team to build it

A strong pitch opens doors to more detailed conversations with potential investors.

5. Network with Potential Investors

Funding is often about who you know as much as what you’re building. Start building connections early.

- Attend startup networking events, pitch nights, and demo days

- Use LinkedIn and Twitter to engage with angel investors and VCs

- Join accelerators and incubators to gain access to funding networks

- Don’t hesitate to ask for warm introductions from mutual connections

6. Consider Joining an Accelerator or Incubator

Startup accelerators and incubators not only offer mentorship but often include seed funding.

- Examples: Y Combinator, Techstars, 500 Startups, MassChallenge

- Offer support in exchange for equity

- Provide access to investors, mentors, and resources

- Help you refine your pitch and product for market launch

7. Apply for Government Grants and Programs

The U.S. government offers non-dilutive grants and loans for startups in specific sectors.

- Small Business Innovation Research (SBIR)

- Small Business Technology Transfer (STTR)

- Local and state economic development programs

- Visit grants.gov or the SBA website for opportunities

8. Be Prepared for Due Diligence

When an investor is interested, they’ll conduct due diligence before handing over any money.

- Have your financials, legal documents, and cap table ready

- Be transparent about any risks or liabilities

- Make sure your business is registered and compliant

- Show strong traction or customer validation if possible

9. Learn to Negotiate Terms

Don’t just focus on the funding amount. Understand the terms and conditions attached to the deal.

- Learn about equity, valuation, dilution, convertible notes, and SAFE agreements

- Don’t give up too much control early on

- If possible, work with a startup lawyer or advisor during negotiations

10. Keep Building Even if You Don’t Get Funded Right Away

Not every investor will say yes—and that’s okay. Keep improving your product, building traction, and refining your pitch.

- Focus on growth and customer feedback

- Reapply to investors or accelerators when you’re further along

- Show momentum to attract future funding rounds